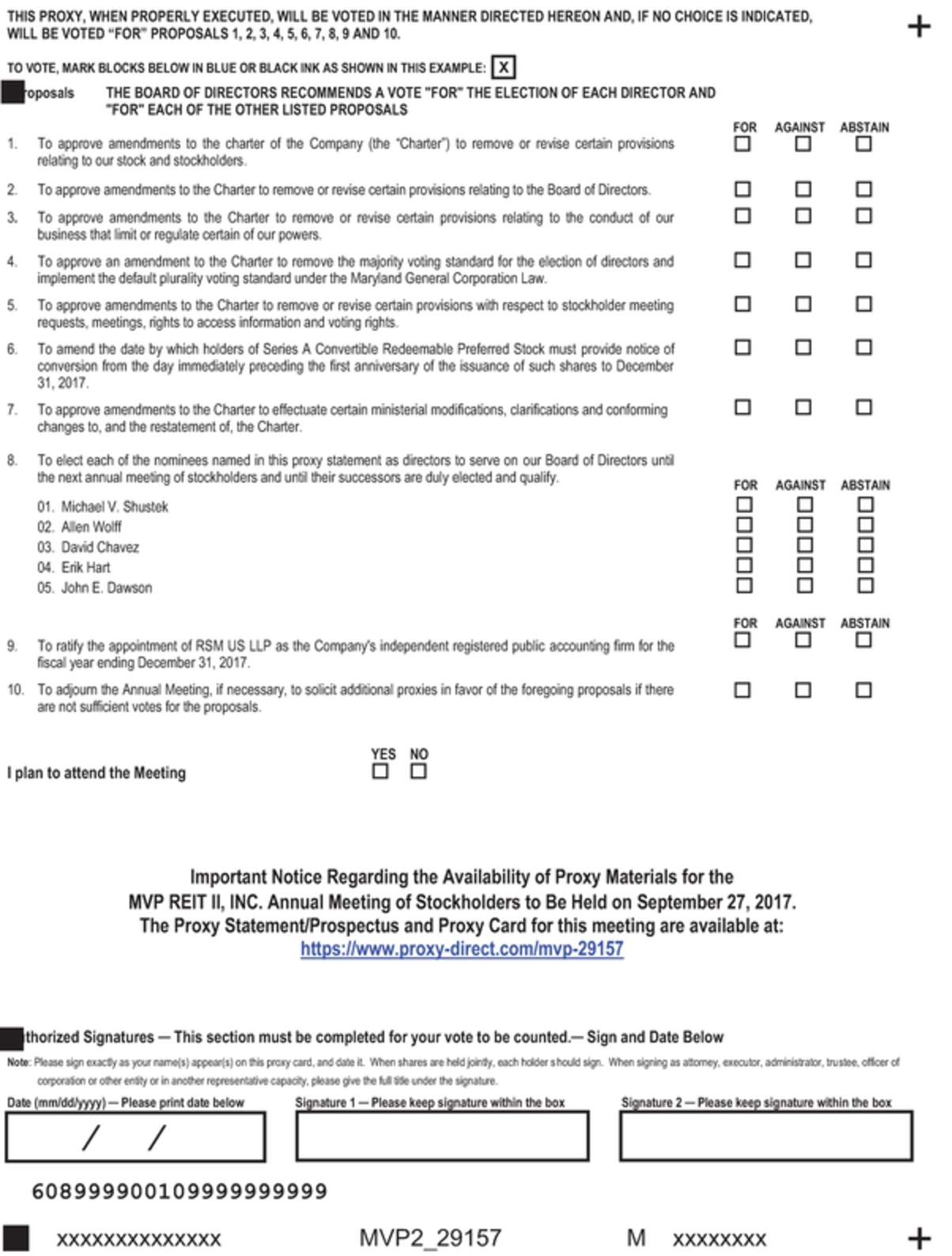

PROPOSAL 8 – ELECTION OF DIRECTORS

Information About

General

Our Board

of DirectorsGeneral

Our board currently consists of five members, Michael V. Shustek, Allen Wolff, David Chavez, Erik Hart and John E. Dawson. directors. However, Nicholas Nilsen, one of our current directors, will not be standing for re-election at the Annual Meeting. The Board has determined that, concurrently with the conclusion of Mr. Nilsen’s term, the size of the Board shall be decreased to four. Thus, stockholders will be voting on the election of four nominees to serve as directors at the Annual Meeting.

Based on the recommendation of the Nominating Committee of the Board of Directors, the Board of Directors nominated the four directors listed below for election to the Board of Directors at the Annual Meeting. All of the nominees are willing to serve as directors but, if any of them should decline or be unable to act as a director, the individuals designated in the proxy card as proxies will exercise the discretionary authority provided to vote for the election of a substitute nominee selected by our Nominating Committee or our Board of Directors, unless the Board of Directors alternatively acts to reduce the size of the Board of Directors or maintain a vacancy on the Board of Directors in accordance with our bylaws. The Board of Directors has no reason to believe that any nominee listed below will be unable or unwilling to serve.

Each of the nominees meetmeets the qualifications for directors as set forth in the Company’sCompany's charter and bylaws. The combined company’s directorsEach of the Company's nominees for director elected at the Annual Meeting will serve until the next annual meeting of stockholders following theirhis election and until their successors arehis successor is duly elected and qualify. Assuming the merger is consummated, concurrently upon the effectivenessqualifies or until his resignation, retirement or removal. We believe that all of the merger,nominees possess the Company will increaseprofessional and personal qualifications necessary for Board service, and have highlighted particularity noteworthy attributes for each nominee in the sizeindividual biographies below.

Recommendation of

its Board by three and the Board

will elect three members of

the MVP I board, Robert J. Aalberts, Nicholas Nilsen and Shawn Nelson, to serve as members of the board of the combined company.Directors

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR EACH OF THE NOMINEES FOR DIRECTOR, WITH EACH TO SERVE UNTIL THE NEXT ANNUAL MEETING OF STOCKHOLDERS AND UNTIL HIS OR HER SUCCESSOR IS DULY ELECTED AND QUALIFIES.

The following table sets forth certain information with respect to each of the persons who are nominated to serve as directors of the company.Company.

| Name | | Age | | Title |

| Michael V. Shustek | | | Name61

| Age

| Position

Chairman of the Board and Chief |

Michael V. Shustek

Robert J. Aalberts | | | 58

68 | | Chief Executive Officer & Director

|

Allen Wolff

| 45

| Independent Director |

David Chavez

| 51

| Independent Director

|

Erik Hart

| 46

| Independent Director

|

John E. Dawson | | | 62 | | Lead Independent Director |

| Shawn Nelson | | | 5954

| | Independent Director |

| Directors of the Company | | | | | |

The following table sets forth the names, ages as of March 24, 2017 and positions

Michael V. Shustek has been Chief Executive Officer of the individuals whoCompany since its inception and currently serves as Chairman of the Board of Directors. Mr. Shustek also served as Chief Executive Officer and a director of MVP REIT, Inc., a Maryland corporation (“MVP I”), prior to the merger (the “Merger”) of MVP I with and into MVP Merger Sub, LLC, a Delaware limited liability company and a wholly-owned subsidiary of the Company. Mr. Shustek has served as chairman of the board, Chief Executive Officer and a director of Vestin Group since April 1999 and a director and Chief Executive Officer of Vestin Realty Mortgage II, Inc., a Maryland corporation (“VRM II”), and Vestin Realty Mortgage I, Inc., a Maryland corporation (“VRM I”), since January 2006.

In 2003, Mr. Shustek became the Chief Executive Officer of Vestin Originations, Inc. In 1997, Mr. Shustek was involved in the initial founding of Nevada First Bank, with the largest initial capital base of any new state charter in Nevada’s history at that time.

Mr. Shustek received a Bachelor of Science degree in Finance at the University of Nevada, Las Vegas.

Mr. Shustek was selected to serve as

directors, executive officersa director because he is our Chief Executive Officer, has significant real estate experience and

certain significant employeesexpansive knowledge of the

Advisor or our affiliates:Name

| Age

| Title

|

Michael V. Shustek

| 58

| President & Chief Executive Officer

|

Ed Bentzen

| 40

| Chief Financial Officer

|

There are no familyreal estate industry, and has relationships between any directors or executive officers, or between any directorwith chief executives and executive officer.

Board Leadership Structure

Ourother senior management at numerous real estate companies. Based on the foregoing, the Board of Directors believes that Mr. Shustek will continue to bring a unique and valuable perspective to our Board of Directors.

John E. Dawson is one of our independent directors and, since April 13, 2019, has determined thatbeen our Lead Independent Director. He had also been a director of MVP I from the beginning of its current structure, with combined Chairmanoperations until the date of the Merger. He was a director of Vestin Group from March 2000 to December 2005, was a director of VRM II from March 2007 until he resigned in November 2013 and CEO roles, iswas a director for VRM I from March 2007 until January 2008. Mr. Dawson has been a lawyer in private practice for over 30 years. Mr. Dawson received his Bachelor’s Degree in Accounting from Weber State University and his Juris Doctor from Brigham Young University. Mr. Dawson received his Masters of Law (L.L.M.) in Taxation from the University of San Diego in 1993. Mr. Dawson was admitted to the Nevada Bar in 1988 and the Utah Bar in 1989. Mr. Dawson was selected to serve as an independent director of the Company due to his legal background and significant experience in the best interestsreal estate industry and his experience as a public company director.

Robert J. Aalberts served as an independent director of MVP I, and was a director of Vestin Group, Inc., from April 1999 to December 2005. He was a director for VRM I from January 2006 until he resigned in January 2008 and for VRM II from January 2006 until he resigned in November 2013. Most recently, Professor Aalberts was Clinical Professor of Business Law in the Smeal College of Business at Pennsylvania State University in University Park, PA from 2014 to June 2017. Prior to his position at Penn State, Professor Aalberts held the Ernst Lied Professor of Legal Studies professorship in the Lee College of Business at the University of Nevada, Las Vegas from 1991 to 2014. Before UNLV, Professor Aalberts was an Associate Professor of Business Law at Louisiana State University in Shreveport, LA from 1984 to 1991. From 1982 through 1984, he served as an attorney for the Gulf Oil Company in its New Orleans office, specializing in contract negotiations and mineral law. From 1992 to 2016, Professor Aalberts was the Editor-in-chief of the Real Estate Law Journal published by the Thomson-West Publishing Company. The Board believes that combiningProfessor Aalberts received his Juris Doctor degree from Loyola University in New Orleans, Louisiana, a Master of Arts from the ChairmanUniversity of Missouri, Columbia, and CEO roles isa Bachelor of Arts degree in Social Sciences and Geography from Bemidji State University in Minnesota. He was admitted to the appropriate corporate governance structure and works well forState Bar of Louisiana in 1982 (currently inactive status). Mr. Aalberts was selected to serve as an independent director of the Company because it most effectively utilizesdue to his significant experience in the real estate industry and his experience as a public company director.

Shawn Nelson is one of our independent directors. Mr.

Shustek’s extensive experienceNelson previously served as an independent director of MVP I. Effective January 7, 2019, Mr. Nelson became the Chief Assistant District Attorney of Orange County, California. Mr. Nelson had served as a member of the Orange County Board of Supervisors in Orange County, California, since June 2010, serving as chairman in 2013 and

knowledge regarding2014. Mr. Nelson previously served on the board of the Southern California Regional Rail Authority (Metrolink) and was the former Chairman. He was also previously a director of the Orange County Transportation Authority having served as the chair in 2014 and is a director of the South Coast Air Quality Management District, Southern California Association of Governments, Transportation Corridor Agency, Foothill/Eastern, Southern California Water Committee, Orange County Council of Governments and Orange County Housing Authority Board of Commissioners. Mr. Nelson resigned from his positions on the board of the Southern California Regional Rail Authority and the Orange County Transportation Authority effective January 7, 2019. From 1994 to 2010, Mr. Nelson was the managing partner of the law firm of Rizio & Nelson. From 1992 to 1994, he was the Leasing Director/Project Manager of S&P Company. Prior to that, from 1989 to 1992 Mr. Nelson served as the Leasing Director/Acquisitions Analyst for IDM Corp and from 1988 to 1989 he served as a Construction Superintendent for Pulte Homes. Mr. Nelson has a Bachelor of Science degree in business with a certificate in real property development from the University of Southern California and a Juris Doctor Degree from Western State University College of Law. Mr. Nelson was selected to serve as an independent director of the Company

due to his legal background and significant experience in the

Company’s businessreal estate industry and

markets, and the Company’s competitors, and provides for the most effective leadership of our Board and Company.Board’shis experience as a director.

Board's Role in Risk Oversight

The Board provides supervision and oversight of our risk management processes. Management identifies and prioritizes material risks, and each prioritized risk is referred to a Board committee or the full Board for supervision and oversight. For example, financial risks are referred to the Audit Committee. The Board regularly reviews information regarding our properties, loans, operations, liquidity and capital resources. The Board informally reviews the risks associated with these items at each quarterly Board meeting and at other Board meetings as deemed appropriate.

Board Leadership Structure

The Board leadership structure is currently comprised of (1) a combined Chairman of the Board of Directors and Chief Executive Officer, (2) a Lead Independent Director, and (3) an independent Chair for each of our three standing Board committees described below. From time to time, the Nominating Committee and the entire Board of Directors review the Company's leadership structure, including the positions of Chairman of the Board and Chief Executive Officer, to ensure the interests of the Company and its stockholders are best served. The Nominating Committee and the Board of Directors believe that the most effective leadership structure for the Company at this time is for Mr. Shustek to serve as both the Chairman of the Board of Directors and Chief Executive Officer. Mr. Shustek’s combined role as Chairman and Chief Executive Officer serves as a bridge between the Board of Directors and management and provides unified leadership for developing and implementing our strategic initiatives and business plans. The Board of Directors also believes that the combined Chairman and Chief Executive Officer structure provides clearer accountability to our stockholders and allows one person to speak for and lead the Company and the Board of Directors. In addition, the Board of Directors believes that its information flow, meetings, deliberations, and decision- making processes are more focused, efficient, and effective when the Chairman and Chief Executive Officer roles are combined. The combined role is counterbalanced and enhanced by the effective oversight and independence of the Board of Directors and the leadership of the Lead Independent Director and independent committee chairs. Moreover, the Board believes that the appointment of a strong Lead Independent Director and the use of executive sessions of the non-management and independent directors, along with the Board of Directors' strong committee system, allow it to maintain effective oversight of management.

Lead Independent Director

The Lead Independent Director's specific responsibilities include, among other things, presiding over all meetings of the Board of Directors at which the Chairman is not present, including executive sessions of independent directors, calling meetings of independent directors, functioning as a liaison with the Chairman, approving board meeting agendas and scheduling and conferring with the Chairman on strategic planning matters and transactions. Our current Lead Independent Director is John Dawson. Mr. Dawson is an engaged and active director, who is uniquely positioned to work collaboratively with Mr. Shustek, while providing strong independent oversight.

Under our current charter and bylaws, and consistent with the requirements of the NASAA REIT Guidelines, the affirmative vote of the holders of a majority of the shares of our common stock entitled to vote who are present in person or by proxy at the Annual Meeting is required to elect each of the nominees named in this proxy statement as directors. For purposesa director.

The following table sets forth the names, ages and positions of the electionindividuals who serve as executive officers:

| Name | Age | Title |

| Michael V. Shustek | 61 | Chairman of the Board and Chief Executive Officer

|

| Daniel Huberty | 52 | President and Chief Operating Officer |

| J. Kevin Bland | 57 | Chief Financial Officer |

Please see “Proposal One: Election of directors, abstentions and broker non-votes, if any, will have the same effect as votes against the election of eachDirectors – Directors of the nominees, although abstentionsCompany” for information regarding Mr. Shustek. There are no family relationships among our executive officers and broker non-votes, if any, will be considered presentdirectors.

Daniel Huberty is the Company's President and Chief Operating Officer. Prior to his election as President and Chief Operating Officer in connection with the Internalization (as defined below), he served as Vice President of Parking Operations for the purposeAdvisor. Prior to his relationship with the Company, Mr. Huberty served as an Executive Vice President of determiningSP Plus, where he oversaw the presencesouthern division of the company. He was named to this position after successfully overseeing the transition of his team through the integration of Central Parking and Standard Parking. SP Plus's clients included some of the nation's largest owners and operators of mixed-use projects, office buildings, hotels, stadiums and arenas, as well as, airports, hospitals and municipalities.

Prior to his role with SP Plus, Mr. Huberty served as a Vice President for Clean Energy Fuels, the largest provider of Compressed Natural Gas in the Country focusing on the parking industry, from June 2009 through September 2011. However, the majority of his career was spent with ABM Industries. During his nearly 17 years with ABM commencing in 1993, Mr. Huberty served in various roles starting as a Facility Manager, working his way up to Regional Manager, Regional Vice President, and finally Vice President of Sales for ABM's Parking Division. Mr. Huberty earned his BBA from Cleveland State University in 1991, and his MBA from the University of Phoenix in 1998.

Mr. Huberty is active in political affairs, serving as a State Representative for Texas House District 127, representing a constituency of more than 160,000 residents. Elected in 2010, he travels to the Capitol in Austin, Texas, every other year to represent them during the legislative session.

Mr. Huberty serves on the Board for the Be an Angel Fund, which is a non-profit board that supports profoundly deaf and handicapped children in Texas. Mr. Huberty is also a Board Member of the Lake Houston Chamber of Commerce in Harris County Texas, which has over 1,500 members focusing on growing the North East Region of Harris County. Mr. Huberty also served as a Trustee for the Humble Independent School District which has 42,000 students, from 2006 to 2010, serving as its President from 2009-2010.

J. Kevin Bland is Chief Financial Officer of the Company and is a certified public accountant. Mr. Bland has over 25 years of experience as a financial professional and executive. Mr. Bland served as Chief Financial Officer of UMTH General Services, L.P. from June 2008 to November 2018. From 2007 to 2008 Mr. Bland served as Vice President, Controller and Principal Accounting Officer of Pizza Inn, Inc. (Nasdaq: RAVE). Mr. Bland spent three years with Metromedia Restaurant Group as Vice President, Controller from 2005 to 2007 and Accounting Manager from 2001 to 2002. From 2003 to 2005, Mr. Bland was Company Controller of Sendera Investment Group, LLC and controller of a quorum.homebuilding and land division with Lennar Corporation in Dallas, Texas from 2002 to 2003. Mr. Bland began his career with Ernst & Young in 1989. Mr. Bland earned a bachelor's degree in accounting from The University of Texas at Austin in 1985 and an MBA from Texas Christian University in 1989.

Prior to April 1, 2019 (the effective date of the Internalization), the Company had no employees. Each of the Company’s executive officers was employed or compensated by the former Advisor. Although the Company reimbursed the former Advisor for certain expenses incurred in connection with providing these services to the Company, prior to the Internalization, the Company did not pay any compensation directly to the Company’s executive officers. Consequently, through March 31, 2019, we did not have a compensation policy or program for our executive officers.

This section discusses the material components of the executive compensation program that we provided in 2019 following the Internalization for our executive officers who are named in the “Summary Compensation Table” below (our “Named Executive Officers”). In 2019, our Named Executive Officers and their positions were as follows:

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR EACH OF THESE NOMINEES.

Biographical Information for Nominees for Director

Michael V. Shustek, will serve asChief Executive Officer (“CEO”);

Daniel Huberty, President and Chief Operating Officer (“COO”); and

James Kevin Bland, Chief Financial Officer (“CFO”).

2019 Salaries

The named executive officers receive a base salary to compensate them for services rendered to our company. The base salary payable to each named executive officer is intended to provide a fixed component of compensation reflecting the executive’s skill set, experience, role and responsibilities. The named executive officer’s base salaries are set forth in employment agreements with the company and currently remain unchanged.

2019 Bonuses

Any annual bonus or incentive pay for the Company’s Named Executive Officers is discretionary and determined by the Compensation Committee for the Chief Executive Officer and Chairman ofby the Board of the combined company, positions he has held at both MVP I and MVP II since their respective inceptions. He also serves asCompensation Committee with appropriate input from the Chief Executive Officer for the President and Chief Operating Officer and the Chief Financial Officer. The actual annual cash bonuses awarded to each named executive officer for 2019 performance are set forth below in the Summary Compensation Table in the column entitled “Bonus.”

Equity Compensation

As described below under “Employment Agreements”, pursuant to his Employment Agreement, each of our Named Executive Officers is eligible to receive an annual target equity award. In light of the Advisor. HeCompany’s common stock not being listed on a public exchange during 2019, no equity compensation was awarded to the company’s Named Executive Officers in 2019.

Retirement Plans and Health and Welfare Benefits

We currently maintain a 401(k) retirement savings plan for our employees, including our Named Executive Officers, who satisfy certain eligibility requirements. None of our Named Executive Officers participated in the Company’s 401(k) retirement savings plan subsequent to the time in which they became Company employees following the end of the Employee Leasing Period under the Employee Leasing Agreement on June 30, 2019. The Internal Revenue Code allows eligible employees to defer a portion of their compensation, within prescribed limits, on a pre-tax basis through contributions to the 401(k) plan. We are permitted to make Safe Harbor matching contributions under the 401(k) plan as follows: 100% of the first 3% of the participant’s compensation and 50% up to the next 2% of the participant’s compensation, with these matching contributions being fully vested as of the date on which the contribution is made. We believe that providing a vehicle for tax-deferred retirement savings though our 401(k) plan adds to the overall desirability of our executive compensation package and further incentivizes our employees, including our Named Executive Officers, in accordance with our compensation policies. We do not currently provide for pension plans, supplemental retirement plans or deferred compensation plans for our Named Executive Officers.

Our Named Executive Officers, are eligible to participate in the health, life insurance, disability benefits and other welfare programs that are provided generally to our employees.

Perquisites and Other Personal Benefits

We do not currently provide our Named Executive Officers with any material perquisites or other personal benefits.

Summary Compensation Table

The following Summary Compensation Table shows compensation paid or accrued by us for services rendered from April 1, 2019 through December 30, 2019 to the Named Executive Officers:

Name and Principal Position | Fiscal Year | | Salary ($)1 | | | Bonus ($) | | | Stock Awards ($) | | | All Other Compensation ($) (1) | | | Total ($) | |

Michael V. Shustek | 2019 | | $ | 275,000 | | | | 125,000 | | | | - | | | | - | | | $ | 400,000 | |

| Chief Executive Officer | | | | - | | | | - | | | | - | | | | - | | | | - | |

Daniel Huberty | 2019 | | $ | 150,000 | | | | - | | | | - | | | | - | | | $ | 150,000 | |

| President and Chief Operating Officer | | | | - | | | | - | | | | - | | | | - | | | | - | |

J. Kevin Bland | 2019 | | $ | 125,000 | | | $ | 90,000 | | | | - | | | | - | | | $ | 215,000 | |

| Chief Financial Officer | | | | - | | | | - | | | | - | | | | - | | | | - | |

1 Salary reflects the amount that was paid to the Named Executive Officers by the Company commencing with the period they became Company employees following the end of the Employee Leasing Period under the Employee Leasing Agreement on June 30, 2019.

Employment Agreements

In connection with the Internalization, the Company entered into employment agreements (collectively, the “Employment Agreements”) with each of our Named Executive Officers on March 29, 2019.

As part of the Company’s transition to self-management, the Compensation Committee retained FTI Consulting as an independent compensation consultant to advise the Compensation Committee with respect to the terms of the Employment Agreements.

Following is a brief summary and discussion of the terms of the Employment Agreements.

Term. Each of the Employment Agreements provides for a three-year initial term that commenced on July 1, 2019 and ends on the third anniversary of such date. Thereafter, the employment term extends automatically for successive one-year periods unless either the Executive or the Company provides notice of non-renewal to the other party at least ninety (90) days before the end of the then-existing term.

Duties. The Employment Agreements provide that the CEO, the COO and the CFO will perform duties and provide services to us that are customarily associated with the duties, authorities and responsibilities of persons in similar positions as well as such other duties as may be assigned from time to time. The Employment Agreements also provide that the Executives generally will devote substantially all of their business time and attention to the business and affairs of the Company, except that the Executives may engage in certain outside activities that do not materially interfere with the performance of their duties.

Compensation. The Employment Agreements provide that the CEO, the COO and the CFO will receive an annual initial base salary of $550,000, $300,000 and $250,000, respectively. The CEO, COO and CFO will be eligible to receive a target annual incentive award of not more than $250,000, $153,000 and $50,000, respectively, and each will be eligible to receive an annual target equity award of not more than $1,000,000, $153,000 and $130,000 in the form of restricted shares of common stock, respectively. Each annual equity award shall vest equally in annual installments over a three-year period. The amounts and conditions for the payment and vesting (as applicable) of each target annual incentive award and each annual target equity award will be determined by the Compensation Committee. The Company at its discretion may pay any target annual incentive awards payable to the COO or the CFO in cash or shares of common stock. Each of the Executives will be eligible to participate in employee benefit programs made available to the Company’s employees from time to time and to receive certain other perquisites, each as set forth in their respective Employment Agreements.

Severance Payments. The CEO Employment Agreement provides that, subject to the execution of a release and other conditions set forth in the CEO Employment Agreement, upon a “qualifying termination” (as defined in the CEO Employment Agreement), the CEO will be entitled to severance based on a multiple of the total of the CEO’s then-current annual base salary plus the amount of the last annual incentive award earned by the CEO in the year prior to termination (referred to herein as “total cash compensation”). If the qualifying termination results from the death or disability of the CEO, the CEO will be entitled to severance equal to one times (1x) his total cash compensation. If the CEO is terminated by the Company without “cause” (as defined in the CEO Employment Agreement), or the CEO quits for “good reason” (as defined in the CEO Employment Agreement) or the Company elects not to renew the term of the CEO employment agreement, then the CEO will be entitled to severance equal to two times (2x) his total cash compensation. In the event that any qualifying termination occurs on or within 12 months after a change in control of the Company, the CEO will be entitled to severance equal to three times (3x) his total cash compensation.

The COO and CFO Employment Agreements provide that, subject to the execution of a release and other conditions set forth in the Employment Agreements, the COO and CFO will be entitled to receive severance based on a multiple of the sum of their annual base salary and target annual incentive award (referred to herein as “total cash compensation”). If the COO is terminated due to his death or disability or if the COO Employment Agreement is not renewed by the Company during the first five years of the term of such agreement, then the COO will be entitled to severance equal to one times (1x) his total cash compensation. Such severance is not payable if the COO Employment Agreement is not renewed by the Company after the first five years of the term. If the COO is terminated without “cause” or the COO quits for “good reason,” (each as defined in the COO Employment Agreement) he will be entitled to severance equal to two times (2x) his total cash compensation. If the CFO is terminated due to his death or disability, he is terminated by the Company without “cause” or he quits for “good reason,” (each as defined in the CFO Employment Agreement) then the CFO will be entitled to severance equal to one times (1x) his total cash compensation. If the CFO is terminated without “cause” or quits for “good reason”, in each case, on or within 12 months after a change in control of the Company, then the CFO will be entitled to severance equal to one and one- half times (1.5x) his total cash compensation.

Upon termination where severance is due and payable, the Employment Agreements also provide that the Executives will be entitled to receive (i) unpaid base salary earned through the termination date; (ii) any restricted shares of common stock that have vested as of the termination date; (iii) all other equity-based awards held by the Executive (which, to the extent subject to time-based vesting, will vest in full at the termination date); (iv) health insurance coverage, including through COBRA, for an 18 month period following the termination date (other than, with respect to the COO and CFO in the event of a termination due to death, disability or non-renewal); and (v) reimbursements of unpaid business expenses.

Non-Competition, Non-Solicitation and Confidentiality. Each Employment Agreement provides that for a two-year period following the termination of the Executive’s employment with us, the Executive will not solicit our employees or consultants or any of our customers, vendors or other parties doing business with us. Pursuant to the Contribution Agreement (as defined below), the CEO has served as Chairmanagreed not to compete with us for a period of three years after the Effective Date (as defined below). Pursuant to the COO and CFO Employment Agreements, each of the COO and CFO has agreed not to compete with us for a period of two years following the termination of their employment with us. Each Employment Agreement also contains covenants relating to the treatment of confidential information, Company property and certain other matters.

Independent Directors

Under the Company’s independent director compensation program in effect until June 5, 2019, the Company paid each independent director an annual retainer of $30,000 (to be prorated for a partial term), with an additional $5,000 annual retainer (to be prorated for a partial term) paid to the Audit Committee chairperson. Each independent director also received $500 for each meeting of the board of directors attended in-person or by telephone.

On April 13, 2019, the Board of Directors voted to change the compensation structure of independent directors. Effective June 5, 2019, the date of the Company’s 2019 annual shareholder meeting, each independent director will receive an annual cash retainer of $70,000, pro-rated for any partial year of service. An additional $20,000 in cash will also be paid to the Lead Independent Director and an additional $15,000 in cash will be paid to the chair of the Audit Committee. In the event that the Company’s stock is listed on a public exchange, each independent director will receive his or her compensation for services on the Board in stock until he or she holds shares of the Company's stock equal to $105,000 (i.e., three times the anticipated cash portion of his or her annual retainer following any such listing), and once the threshold is met, each independent director will receive his or her annual retainer half in shares of stock and half in cash.

In light of the Company’s common stock not being listed on a public exchange during 2019, the decision was made following the April 13, 2019 meeting of the Board of Directors Chief Executive Officerto not pay the full annual cash retainer under the new compensation structure for independent directors and only pay one half of the annual cash retainer during the remainder of 2019. Commencing January 1, 2020, the full annual cash retainer of $70,000 is expected to be paid.

All directors receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attending meetings of the Board of Directors. Directors who are also employees of the Company are not entitled to any compensation for services rendered as a

director of Vestin Group since April 1999 and a director and CEO of Vestin Realty Mortgage I, Inc., a Maryland corporation and OTC Pink Sheets-listed company (“VRM I”), and Vestin Realty Mortgage II, Inc., a Maryland corporation and OTC Pink Sheets-listed company (“VRM II”), since January 2006. In July 2012, Mr. Shustek became a principal of MVP American Securities. During January 2013, Mr. Shustek became the sole owner of MVP American Securities.In February 2004, Mr. Shustek became the President of Vestin Group. In 2003, Mr. Shustek became the Chief Executive Officer of Vestin Originations, Inc. In 1995, Mr. Shustek founded Del Mar Mortgage, and has been involved indirector. The Compensation Committee retained FTI Consulting as its independent consultant to provide guidance on various aspects of our independent director compensation program and to assist the real estate industryCompensation Committee in Nevada since 1990. In 1993, he founded Foreclosuresdesigning an executive compensation program.

The following table sets forth information with respect to our independent director compensation during the fiscal year ended December 31, 2019:

| Name (1) | | Fees Earned or Paid in Cash | | | Total ($) | |

David Chavez (2) | | $ | 11,250 | | | $ | 11,250 | |

| John E. Dawson (3) | | | 60,333 | | | | 60,333 | |

| Robert J. Aalberts | | | 56,292 | | | | 56,292 | |

| Nicholas Nilsen | | | 39,167 | | | | 39,167 | |

| Shawn Nelson | | | 63,821 | | | | 63,821 | |

| Hilda Delgado (4) | | | 11,666 | | | | 11,666 | |

| John Alderfer (5) | | | 6,250 | | | | 6,250 | |

| William Wells (2) | | | 11,250 | | | | 11,250 | |

| Total | | $ | 260,029 | | | $ | 260,029 | |

| (1) | Mr. Shustek, the Chairman of the Board and our CEO, did not receive compensation for his services on our Board in 2019. Mr. Shustek’s 2019 compensation is described in the section above, titled “Summary Compensation Table.” |

| (2) | The Nominating Committee did not re-nominate Mr. Wells nor Mr. Chavez were in June 2019 at our annual stockholders meeting. Each of these directors served out their terms, which ended on June 5, 2019. The amounts shown in the table above reflect their pro-rated fees for 2019. |

| (3) | Mr. Dawson served as our Lead Independent Director for 2019 and as the chair of the Audit Committee for 2019. |

| (4) | Ms. Delgado resigned from the Board on August 9, 2019. |

| (5) | Mr. Alderfer resigned from the Board on July 16, 2019. |

Long-Term Incentive Plan

The Company’s Board of

Nevada, Inc.,Directors has adopted a

company specializing in non-judicial foreclosures. In 1997, Mr. Shustek was involvedlong-term incentive plan which the Company may use to attract and retain qualified directors, officers, employees and consultants. The Company’s long-term incentive plan will offer these individuals an opportunity to participate in the

initial foundingCompany’s growth through awards in the form of,

Nevada First Bank. In 1993, Mr. Shustek also started Shustek Investments, a company that originally specialized in property valuations for third-party lenders or

investors.Mr. Shustek has co-authored two books, entitled “Trust Deed Investments,”based on, the topic of private mortgage lending, and “If I Can Do It, So Can You.” Mr. Shustek is a guest lecturer atCompany’s common stock. The Company does not currently expect to issue awards under the University of Nevada, Las Vegas, where he also has taught a courseCompany’s long- term incentive plan prior to such time as the Company’s stock becomes publicly traded, although it may do so in Real Estate Law and Ethics. Mr. Shustek received a Bachelor of Science degree in Finance at the University of Nevada, Las Vegas. Mr. Shustek is highly knowledgeable with regardfuture, including possible equity grants to the business operationsCompany’s independent directors as a form of MVP Icompensation.

The long-term incentive plan authorizes the granting of restricted stock, stock options, stock appreciation rights, restricted or deferred stock units, dividend equivalents, other stock-based awards and MVP II. In addition, his participation oncash-based awards to directors, officers, employees and consultants of the Company and the Company’s affiliates selected by the board of directors for participation in the Company’s long-term incentive plan. Stock options granted under the long-term incentive plan will not exceed an amount equal to 10% of the combined companyoutstanding shares of the Company’s common stock on the date of grant of any such stock options. Stock options may not have an exercise price that is essentialless than the fair market value of a share of the Company’s common stock on the date of grant.

The Company’s board of directors or a committee appointed by its board of directors will administer the long-term incentive plan, with sole authority to ensure efficient communicationdetermine all of the terms and conditions of the awards, including whether the grant, vesting or settlement of awards may be subject to the attainment of one or more performance goals. No awards will be granted under the long-term incentive plan if the grant or vesting of the awards would jeopardize the Company’s status as a REIT under the Code or otherwise violate the ownership and transfer restrictions imposed under its charter. Unless otherwise determined by the Company’s board of directors, no award granted under the long- term incentive plan will be transferable except through the laws of descent and distribution.

The Company has authorized and reserved an aggregate maximum number of 500,000 common shares for issuance under the long-term incentive plan. In the event of a transaction between the boardCompany and management. Mr. Shustek was selected to serve as a directorits stockholders that causes the per-share value of the combined company because heCompany’s common stock to change (including, without limitation, any stock dividend, stock split, spin-off, rights offering or large nonrecurring cash dividend), the share authorization limits under the long- term incentive plan will be adjusted proportionately and the Chief Executive Officerboard of directors will make such adjustments to the long- term incentive plan and awards as it deems necessary, in its sole discretion, to prevent dilution or enlargement of rights immediately resulting from such transaction. In the event of a stock split, a stock dividend or a combination or consolidation of the combined company, has significant real estate experienceoutstanding shares of common stock into a lesser number of shares, the authorization limits under the long-term incentive plan will automatically be adjusted proportionately and expansive knowledgethe shares then subject to each award will automatically be adjusted proportionately without any change in the aggregate purchase price.

The Company’s board of directors may in its sole discretion at any time determine that all or a portion of a participant’s awards will become fully vested. The board may select among participants or among awards in exercising such discretion. The long-term incentive plan will automatically expire on the tenth anniversary of the

real estate industry,date on which it is approved by the board of directors and

has relationships with chief executives andstockholders, unless extended or earlier terminated by the board of directors. The Company’s board of directors may terminate the long-term incentive plan at any time. The expiration or other

senior management at numerous real estate companies.Allen Wolff will serve as onetermination of the combined company’s independentlong-term incentive plan will not, without the participant’s consent, have an adverse impact on any award that is outstanding at the time the long-term incentive plan expires or is terminated. The board of directors may amend the long-term incentive plan at any time, but no amendment will adversely affect any award without the participant’s consent and currently servesno amendment to the long-term incentive plan will be effective without the approval of the Company’s stockholders if such approval is required by any law, regulation or rule applicable to the long-term incentive plan.

During the years ended December 31, 2019 and 2018, no grants were made under the long-term incentive plan.

Compensation Committee Interlocks and Insider Participation

Other than Michael V. Shustek, no member of the Company’s board of directors served as an

independent directorofficer, and no member of

MVP II. Since December 2014, Mr. Wolff hasthe Company’s board of directors served as

Chief Financial Officer for NTN Buzztime, Inc. (NYSE MKT: NTN), a social entertainment and integrated marketing platform. Previous to that, from July 2013 to December 2014, Mr. Wolff served as Co-Founder and Financial Strategist for PlumDiggity, LLC, a financial and marketing strategy firm. From January 2011 to July 2013, Mr. Wolff served as Chief Financial Officer and director for 365 Retail Markets, LLC, a micro-market self-checkout POS technology firm, and from January 2006 to January 2011, Mr. Wolff served as Co-Founder and Chief Financial Officer of Paysimple, Inc., a provider of payment management solutions. From January 2003 to July 2009, Mr. Wolff served as President and Chief Financial Officer of The Conclave Group, LLC, a real estate industry publication serving 12,000 apartment communities nationwide. Mr. Wolff received his Bachelor’s Degree from the University of Michigan, and his Master of Business Administration Degree from the R.H. Smith School of Business at the University of Maryland. Mr. Wolff was selected to serve as an

independent directoremployee, of the

combined company becauseCompany or any of

his public company accounting and financial reporting expertise, as well as his experience with real estate transactions.David Chavez will serve as oneits subsidiaries during the year ended December 31, 2019. In addition, during the year ended December 31, 2019, none of the combined company’s independent directors and currently serves as an independent director of MVP II. Since 2009, Mr. Chavez hasCompany’s executive officers served as Chief Executive Officer of Assured Strategies, LLC, a strategic consulting, coaching and advisory firm. From 1996 to 2007, Mr. Chavez served as Chief Executive Officer of the Chavez & Koch, a Professional Corporation, Certified Public Accountants (CPA’s), Ltd., certified public accounting firm, and from 1995 to 1996, he was a private business and financial consultant. From 1991 to 1995 Mr. Chavez worked with Arthur Andersen’s Las Vegas office, taking several companies public, and working on auditing as well as consulting. Mr. Chavez received a Bachelor of Science in Business Administration Degree, with a concentration in Accounting, from the University of Nevada, Las Vegas. Mr. Chavez was selected to serve as an independent director of the combined company because of his accounting and financial reporting expertise and his experience in the strategic consulting industry.

Erik A. Hart will serve as one of the combined company’s independent directors and currently serves as an independent director of MVP II. Since May 2012, Mr. Hart has served as Managing Partner for Romandad Partners and the Romandad Trust. Previous to that, from 2001 to July 2013, Mr. Hart practiced law at The Law Offices of